Reshaping the European Financial Landscape

with Intelligence and Strategy

Capital Estelar is an international investment research and asset management company headquartered in New York, USA, with a branch office in Madrid, Spain. We specialize in AI-driven quantitative investing, EU stock market structure research, fund research, private equity investing, and family wealth planning. We are committed to building the next generation of financial literacy through rationality, technology, and education.

The stock market isn't about speculation; it's about

cognitive structure. Only by understanding the market's

rhythm can we see certainty amidst volatility.

Fernando Silva Mendoza, Founder of Capital Estelar

About Capital Estelar

Capital Estelar was founded in Madrid by Professor

Fernando Silva Mendoza, a PhD in finance and senior

institutional trader, and focuses on the long-term recovery

and intelligent transformation of the European capital market.

As a new type of financial institution integrating research, investment consulting, and education, Capital Estelar is committed to providing clients with investment decision-making support based on data science and market psychology.

Our Honors

Our business covers

the following core areas

AI Quantitative Investment System (SGC-Quant)

Asset management and wealth structure planning

Private Equity and Strategic Research

Investment in education and Research Fund Rise

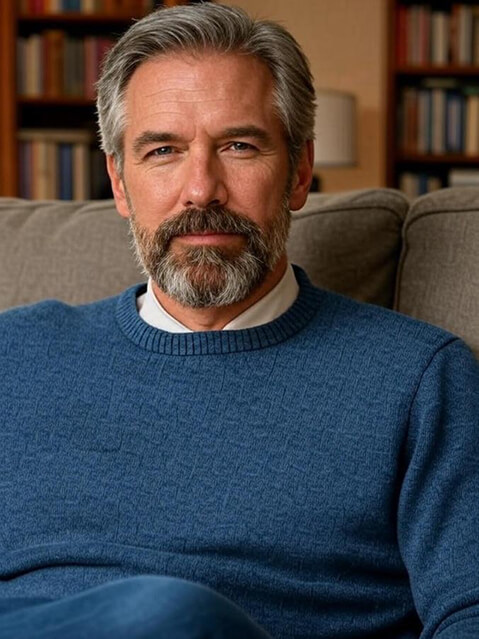

Founder

Professor Fernando Silva Mendoza

- Founder & Chief Investment Officer (CIO) of Capital Estelar

- PhD in Finance · Former Chief Market Analyst at Banco Santander

With over 30 years of experience in European stock market research and institutional investment, he has been active in the Madrid, Barcelona, and New York markets. He is widely recognized as a "stock market prophet" in Spain, having successfully predicted the Spanish stock market's rebound in 2013.

Professor Fernando is known for his "Operación de una semana plus" strategy and "Reverse Cycle Model." His leading SGC-Quant model combines AI with macroeconomic variables to help institutional accounts achieve an annualized return of over 600% between 2023 and 2025.

Beyond investment research, he actively promotes financial education reform, advocating for "bringing institutional thinking to the public," and promoting quantitative and behavioral finance concepts to individual investors. In 2025, he was named one of the "Most Influential Financial Education Figures in Spain" by Cinco Días magazine.

Professor Fernando Silva Mendoza is recognized as one of Europe's most influential private equity fund managers for his exceptional financial strategic vision and cross-border capital operations experience. His career spans academia, investment banking, and venture capital, forging his unique philosophy of "Structural Growth Investing."

Honors and Awards

Core Achievements

Using its proprietary "Reverse Cycle Model," it accurately bottomed out the IBEX 35.

Starting with €2 million, its strategy fund Grew to €380 million in just six years.

This remarkable turnaround was hailed by Expansión magazine as a "turning point in the European capital market." Through its European Technology Growth Fund, managed by Capital Estelar, it successfully invested in 11 unicorn companies, three of which were listed on Nasdaq.

It facilitated numerous cross-border mergers and acquisitions and asset restructurings for companies in Central and Western Europe, with a total transaction value exceeding €3.5 billion.

In recent years, it has actively invested in the RWA (real asset tokenization) and green finance sectors, leading Star Capital to become one of Europe's leading ESG investment firms.

Our Philosophy

Capital Estelar's core philosophy is that rationality, data and education constitute the three pillars of long-term wealth.

Strategy

Estrategia develops multi-dimensional investment strategies from a macro perspective, covering stocks, ETFs, bonds, and alternative assets, and achieves a balance between stable returns and risks through dynamic allocation.

Capital

Capital serves as a bridge connecting businesses and the market. Through flexible capital operations, equity investments, and mergers and acquisitions, we participate in industrial upgrading and long-term growth.

Security

The security and regulatory compliance of our funds are our top priorities. We employ a rigorous custody system and a strict regulatory framework to ensure the stable, long-term growth of our clients' assets.

In volatile markets, we help investors build structured cognition and achieve

stable returns through science and discipline.

Capital Estelar is expanding the boundaries

of financial education and asset

management in Europe through cross-market

research and AI technology.

capitalestelar1@gmail.com

Global Presence

- Headquarters: New York

-

Research Centers:

Madrid, Barcelona, Valencia -

International Collaborations:

Paris, Berlin, Warsaw

Capital Estelar is expanding the boundaries of financial education and asset management in Europe through cross-market research and AI technology.

Contact Us